- Taylor Independent School District

- Taylor ISD Bond 2022

Taylor ISD Bond 2022

-

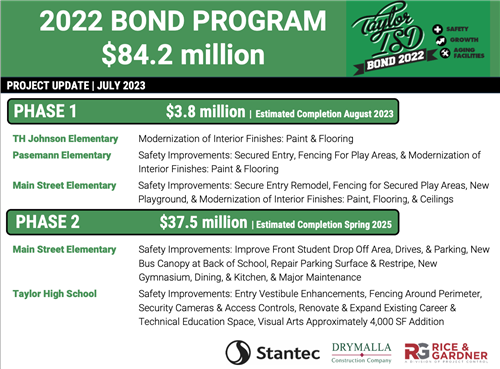

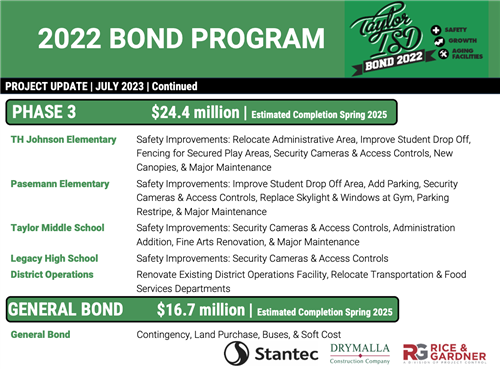

BOND CONSTRUCTION TIMELINE

THE BOND PROGRAM

The Taylor ISD Board of Trustees unanimously approved an order on August 15, 2022, calling for a bond election that projects NO TAX RATE INCREASE to be held on November 8, 2022. The 2022 bond addresses safety, district growth, and aging facilities.

- Safety and Security Updates Across the District

- THS Career and Technical Education (CTE) Addition for Workforce Certification

- Renovation/Modernization of Main Street, Pasemann, TH Johnson Elementary Schools

- Renovation/Modernization of Taylor Middle School

- Major Building Repairs including HVAC/Roof Replacement

- Land Acquisition

The projects included in the bond are based on recommendations from the Taylor ISD Community Advisory Committee (CAC). The CAC, a diverse group of local citizens, parents, and school employees, met four times over several months to examine facility needs, costs, possible projects and to rank these needs. The committee reached 100% consensus in their recommendation and presented to the Taylor Board of Trustees on August 4, 2022.

-

What is included in the 2022 Bond?

-

How do I vote?

To vote, you must be registered. To verify your registration or to register to vote, please visit Williamson

County’s voter registration website www.wilco.org/elections . Deadline to register is October 11. Early

voting is October 24 to November 4. Election day is November 8. Williamson County allows voters to vote

at any open Election Day Vote Center. -

How can a district pay for the bond without raising the tax rate?

Due to increased projected tax revenue due to Samsung, the district can pay off the bonds without raising the rate. For the purpose of paying off bond debt, district collects $0.34 in I&S tax revenue for every $100 of property valuation. The projected value of Samsung becoming operational in 2024-25 will pay off bond debt at the current rate or lower according to our financial advisor. A bond is like a mortgage. The tax revenue we collect on the I&S revenue pays off the mortgage.

-

Did Taylor ISD get community input?

The Community Advisory Committee (CAC), a diverse group of local citizens, parents, and school

employees, met four times over several months to examine facility needs, costs, possible projects and to

rank these needs. Priorities included improving facility safety, land acquisition, adding CTE classrooms at

THS and providing our elementary schools adequate spaces and furniture. The committee reached 100%

consensus in their recommendation. The CAC presented their final recommendation to the Taylor Board

of Trustees on August 4, 2022. -

Will the Taylor ISD Tax rate go up if this bond is approved?

The bond will NOT increase the Taylor ISD tax rate based upon financial projections. In 2019, the Texas Legislature passed legislation requiring the ballot for all school district bond referendums to include the sentence, “This is a property tax increase.” The sentence is required even if no actual tax rate increase will occur. Taylor ISD’s total tax rate for the 2022 tax year, is $1.28 per $100 of assessed valuation ($0.94 M&O + $0.34 I&S) and represents the lowest district tax rate since 2008.

-

How does the school district determine the tax rate?

The school district tax rate in 2015 was $1.45, in 2016 jumped to $1.57 after the 2015 Bond, and stayed there until 2019 when the tax rate dropped to $1.46 due to House Bill 3 and the restructuring of school finance. The 2020 rate was $1.40, 2021 was $1.33, and the 2022 rate is $1.28.House Bill 3 automatically “compresses” the maintenance (M&O) portion of the tax rate when appraisal values grow. This keeps school districts on a "fixed income." M&O revenue supplies revenue for yearly employee compensation, supplies, and utilities. The Taylor Board of Trustees had the option to keep M&O at $0.97 for the 2022 year due to a Winter Storm Uri provision and they decided to lower it to $0.94 out of consideration for taxpayers.The Board of Trustees also chose to lower the Debt Service portion of the tax rate from $0.37 to $0.34 after our financial advisor showed we had over $240M in bond capacity over the next three years. What does bond capacity mean? That means the district can pay off the bond debt in a timely manner without raising the tax rate. Taylor ISD anticipates lowering the tax rate over the next several years. -

If there wasn't a bond or it didn't pass, does that mean our tax rate would go down?

The school board sets the tax rate in August and it stays at that rate until the following year's August board meeting.

As long as the needs of the district exist, it is financially responsible to keep the I&S tax rate (which pays off school bonds) at a level that gives Taylor the capacity to call for a school bond WITHOUT raising the tax rate. The only exception to this would be if the current needs that require a bond (safety, security, land acquisition, CTE opportunities, etc.) no longer existed. -

Taylor ISD has a "bond capacity" of $240M over the next three years. What does that mean?

"Bond Capacity" means the district can pay off the bond debt in a timely manner without raising the tax rate. Taylor ISD anticipates lowering the tax rate over the next several years due to increases in taxable value from large companies in our attendance zone.

-

What happens if the housing market slows down? Will that hurt Taylor's ability to pay for the bond and impact the tax rate?

According to Taylor's financial advisor, the appraisal growth portion we used for projecting a no tax rate increase bond was a combination of Samsung becoming operational and the housing market. In Taylor's case, what is projected from Samsung becoming operational in the 24-25 school year will generate revenue to pay off bond debt in the appropriate time frame.

-

Can the district guarantee no tax increase for the length of the bond?

Taylor ISD has over $240M in bond capacity over the next three years and is only including $82.4M of that total bond capacity in this bond proposition. Lowering the future Taylor ISD tax rate is anticipated because of the planned taxable value of Samsung and other businesses when they become operational.

-

How will 65+ taxpayers be affected?

County and city taxes will not affect the tax bill, or the amount of taxes paid, for anyone over the age of 65 who have filed a homestead exemption. A projected no tax rate increase bond will not affect those over 65 or under 65.

-

Due to Taylor being a Chapter 49 (recapture) district, aka “Robin Hood”, how much bond money will leave Taylor ISD and go back to the state?

Bond funds are not subject to recapture, now known as local revenue in excess of entitlement. All bond funds approved by district voters will remain in Taylor to directly benefit our community.

-

How can this bond help improve pay for teachers and staff in Taylor?

A bond proposition can only be used for facility construction or renovation. Taylor ISD pays thousands of dollars in major maintenance repairs every year out of our operating budget that pays for staff compensation. A bond that pays for major maintenance needs (example: roof and HVAC replacement) helps make funds available to compensate staff.